free cash flow yield s&p 500

In this report our research is based on the latest audited financial data which is the 2020 10-K for most companies. SP 500 Futures Price-to-Free-Cash-Flow as of today July 30 2022 is.

S P 500 Sectors Free Cash Flow Is Up But Prices Are Down Seeking Alpha

There are many ways to do it.

. FCF covers all outgoing cash. Daily chart SP 500 DIVIDEND AND FREE CASH FLOW YIELD INDEX. You can quickly calculate the free cash flow of a company from the cash flow statement.

SP 500 DIVIDEND AND FREE CASH FLOW YIELD INDEX. These are cash cows that have high dividend yields. Start with the total from the cash generated from operations.

The table below shows the list of 22 SP 500 stocks with Enterprise Value Free Cash Flow less than 10x at present. Price data is as of 32321. Historical High Dividend Yields.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. 2021 was a very profitable year for the SP 500. Free cash flow yield.

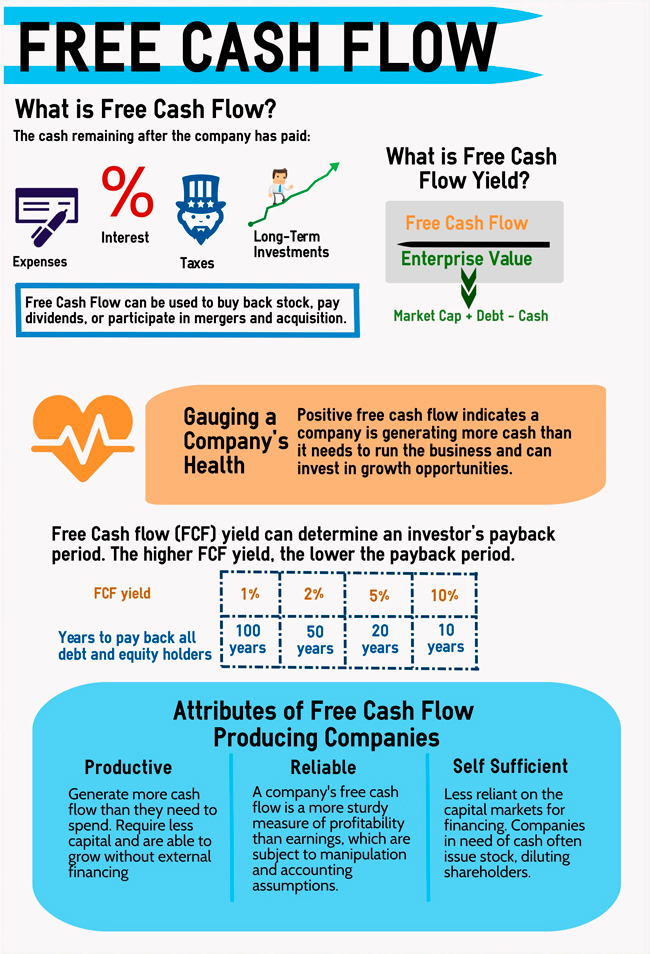

At the end of the first quarter the FCF yield of the SP 500 was. For example you can use high free cash. Then the free cash flow value is divided by the companys value or market cap.

Free cash flow is a lot different from net income. Lets get started today. Ad Were all about helping you get more from your money.

Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to. SP 500 realized contraction in Free Cash Flow by -316 in 2 Q 2022 year on year. The table below includes fund flow data for all US.

2 months 3 months 6 months. This report is an abridged and free version of SP 500 Sectors. Higher Free Cash Flow Is Better.

Ad QuickBooks Financial Software. The first fund is the Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF QDPL which seeks to provide cash distributions equal to 400 of the SP 500 dividend yield in exchange for modestly. The SP 500 Dividend and Free Cash Flow Yield Index is designed to measure the constituents of the SP 500 that exhibit both high dividend yield and sustainable dividend distribution characteristics while maintaining diversified sector exposure.

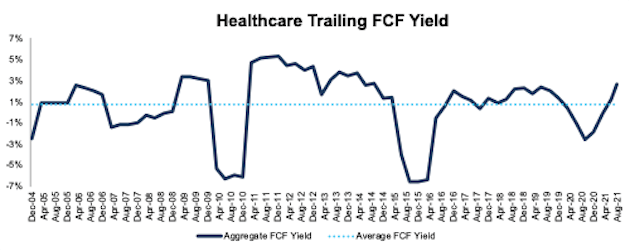

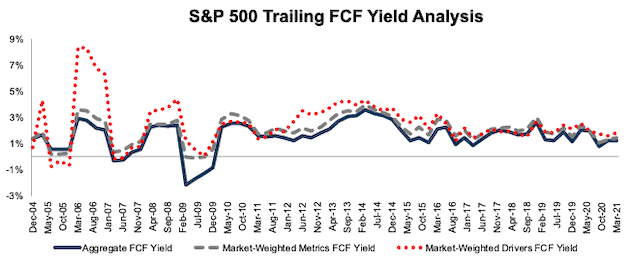

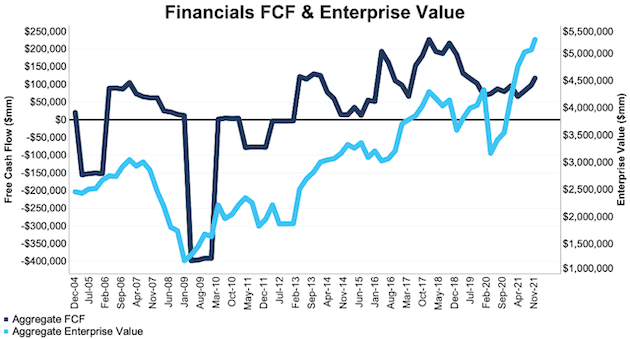

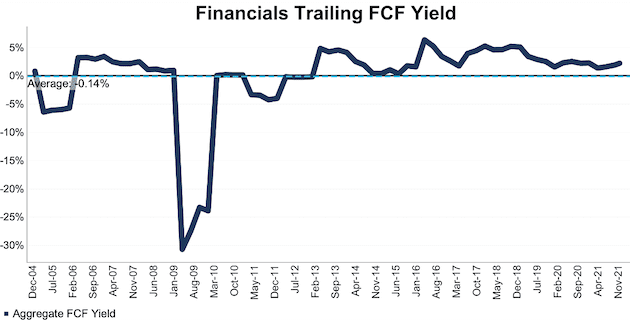

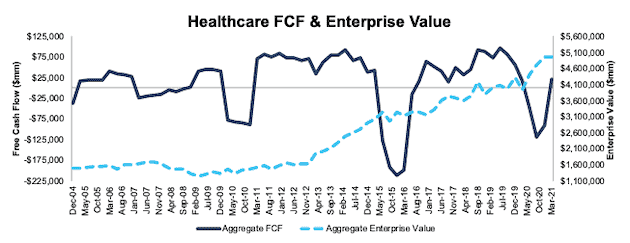

Rated the 1 Accounting Solution. With negative real bond yields here is how you can invest for passive income right now. This report analyzes free cash flow enterprise value and the trailing FCF yield for the SP 500 and each of its sectors.

James Montier Short Screen. From a value angle these stocks are considered cheap. One is to take all the SP500 stocks calculate their Free Cash Flow Yield and either pick the top 10-20 stocks or take stocks having a yield above certain percentage suhas 10 yield.

Free cash flow a subset of cash flow is the amount of cash left over after the company has paid all its expenses and capital expenditures funds reinvested into the company. Ad Each of these 3 companies pays around 10 to its shareholders annually. Afford its 43 dividend yield which is more than double the SP 500s yield.

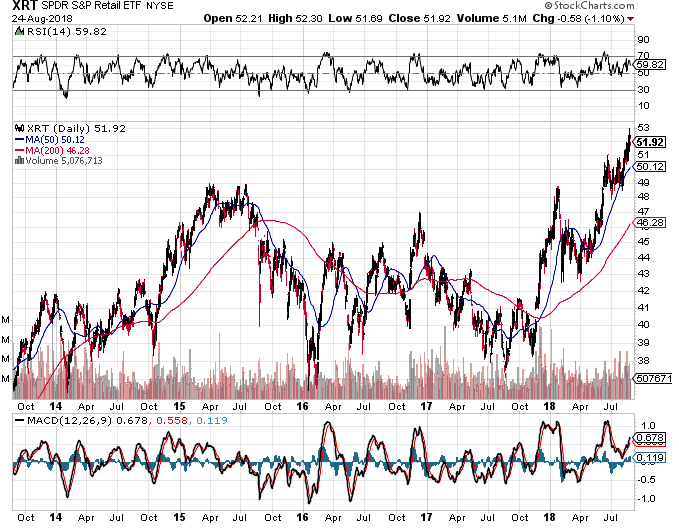

Nearly a third of the entire SP 500s free cash flow this year. Take a look at this chart of the SP 500 the white line plotted against its historical FCF yield in green every quarter since 1990. Free Cash Flow Yield.

High Yield Insider Buys. Is a leading provider of transparent and independent ratings benchmarks analytics and data to the capital and commodity markets worldwide. The higher the FCF yield the better.

Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. Cash is king when the SP 500 turns volatile. You can also combine other metrics such as dividend yield to further shortlist the stocks.

Apples AAPL 12543 free cash flow yield isnt one of the highest amongst the 10 stocks covered. Using the equation of Enterprise Value Free Cash Flow stocks with a lower ratio are favored over those with a higher ratio. Listed Highland Capital Management ETFs.

ETFs Tracking The SP 500 Dividend and Free Cash Flow Yield Index ETF Fund Flow. Free cash flow yield is really just the companys free cash flow divided by its market value. The company operates through four reportable segments.

DividendInvestor is an AwardWinning Dividend Screening Platform. This report analyzes free cash flow FCF enterprise value and the trailing FCF yield for the SP 500 and each of its sectors. The trailing FCF yield for the SP 500 rose from 11 at.

To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations. The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn against its market. SP 500 Dividend and Free Cash Flow Yield Index.

SP Global Ratings Ratings SP Global. Free cash flow TTM. Called the free cash flow yield this gives investors another way to assess the value of a company that is comparable to the PE ratio.

S. International Gurus Top Holdings. Real-time USA - 1025 2022-07-28 am EDT 186770.

In depth view into ES Price-to-Free-Cash-Flow explanation calculation historical data and more. Note second quarter Numbers include only companies who have reported second quarter earnings results. Add to my list.

As you can see the market was super cheap in 2009 based on this metric. Free Cash Flow Yield Through 3Q21 one of the reports in our quarterly series on fundamental market and sector trends available to Pro and higher membersMore free reports on the fundamental trends for the overall market and each sector are available here. The full version of this report analyzes free.

Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. SP 500 FCF Yield in Q4 Rose above Pre-Pandemic Levels. Sequentially Free Cash Flow grew by 5678.

Fcf Yield Increased In Seven S P 500 Sectors Through 2q21 Seeking Alpha

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs

The Power Of Free Cash Flow Yield Pacer Etfs

S P 500 Sectors Free Cash Flow Yield Through 3q21 Free Abridged New Constructs

Is Free Cash Flow Overrated Fo Gurufocus Com

S P 500 Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels

S P 500 Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels

S P 500 Sectors Free Cash Flow Yield Through 3q21 Free Abridged New Constructs

C J Lawrence Weekly Free Cash Flow Is King C J Lawrence Investment Management

C J Lawrence Weekly Free Cash Flow Is King C J Lawrence Investment Management

S P 500 Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels

The S P 500 Median Price To Free Cash Flow Ratio Is Now 34 66 Seeking Alpha

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs

S P 500 Sectors Free Cash Flow Is Up But Prices Are Down Seeking Alpha

Price To Free Cash Flow Ratio Backtest

S P 500 Sectors Free Cash Flow Is Up But Prices Are Down

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs